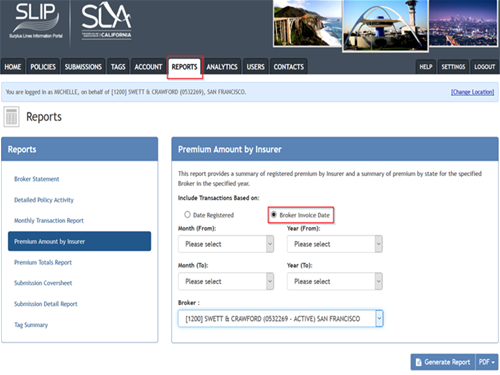

A report of the premium amount by insurer for the transactions that have been processed by the SLA is available in SLIP. In order to produce the report, log-in, click on the REPORTS tab and then click on Premium Amount by Insurer.

Choose the option to include transactions based on Broker Invoice Date.

Enter the date criteria and generate the report in the desired format (PDF, Excel, Word, or CSV).

*If you have a SLIP profile, but cannot see the Reports tab, you might not have the required permissions to view reports in SLIP. The Master User for the account is able to edit permissions.