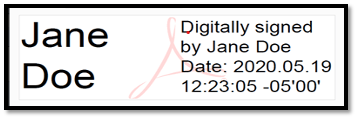

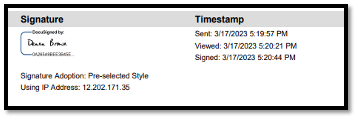

Digital signatures authorized by a digital signature certification authority are acceptable.

As noted on the California Secretary of State’s website, a digital signature is defined as “an electronic identifier, created by computer, intended by the party using it to have the same force and effect as the use of a manual signature.”

Digital signatures must be:

- Specific to the person using it.

- Verifiable.

- Under the exclusive control of the person using it.

- Linked to data so that if information on a signed form are changed, the digital signature becomes invalid.

- Conforms to all other regulations adopted by the Secretary of State, as found on their website: https://www.sos.ca.gov/business-programs/business-entities/faqs/#top.

Examples: